Market Commentary

of June 2024

Market Commentary - June 2024: Upcoming Volatility

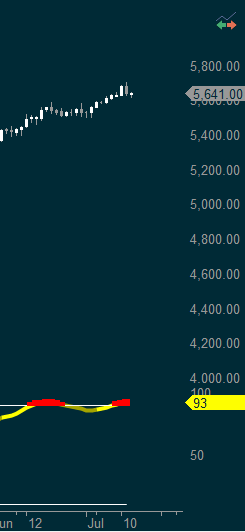

As of July 12th, our flagship algorithm has signaled a short, anticipating a drawdown of at least 10% in the S&P 500 Index (SPX).

Volatility Signals:

Our volatility algorithm has identified a bottoming pattern in the VIX Index at 12.1, forecasting a rise to 20. This anticipated increase in volatility aligns with our expectation of a market correction.

Flagship Model turns overbought:

Concentration Risks:

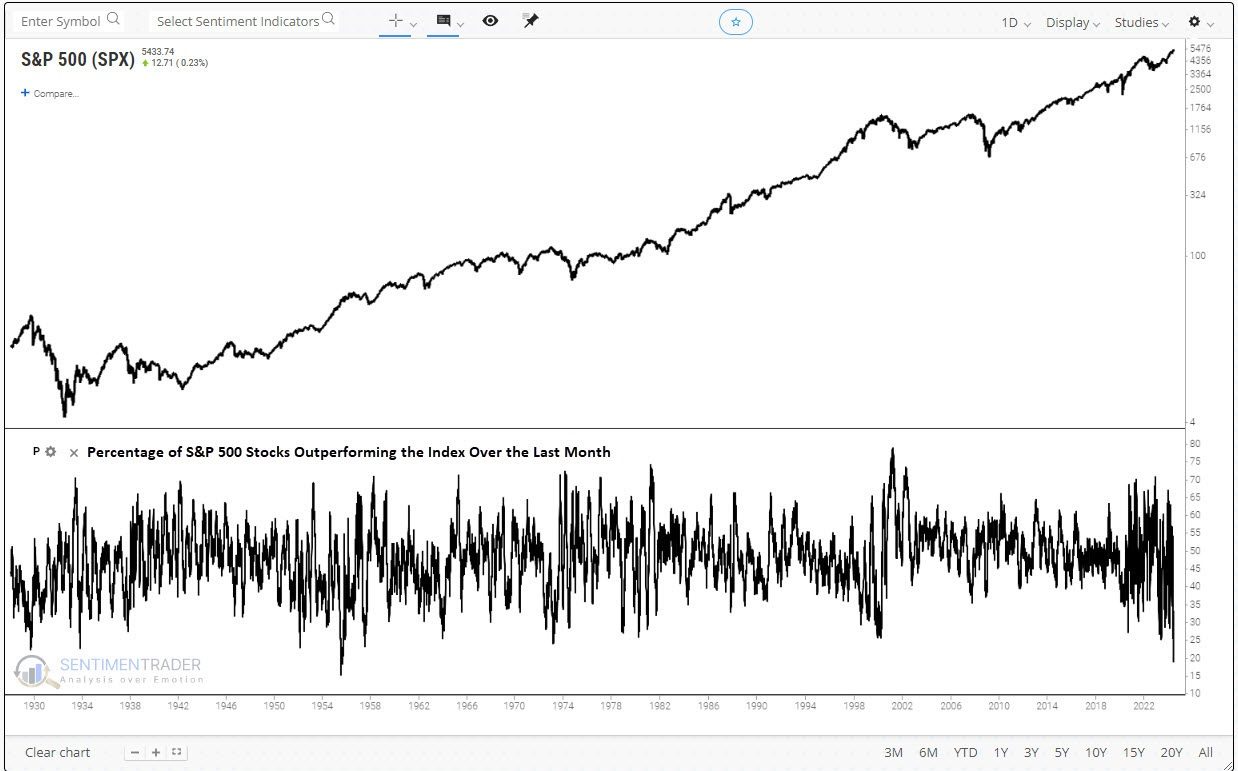

The percentage of SPX stocks outperforming the index is at its lowest level since 1955. Narrow market leadership often precedes broader market weakness.

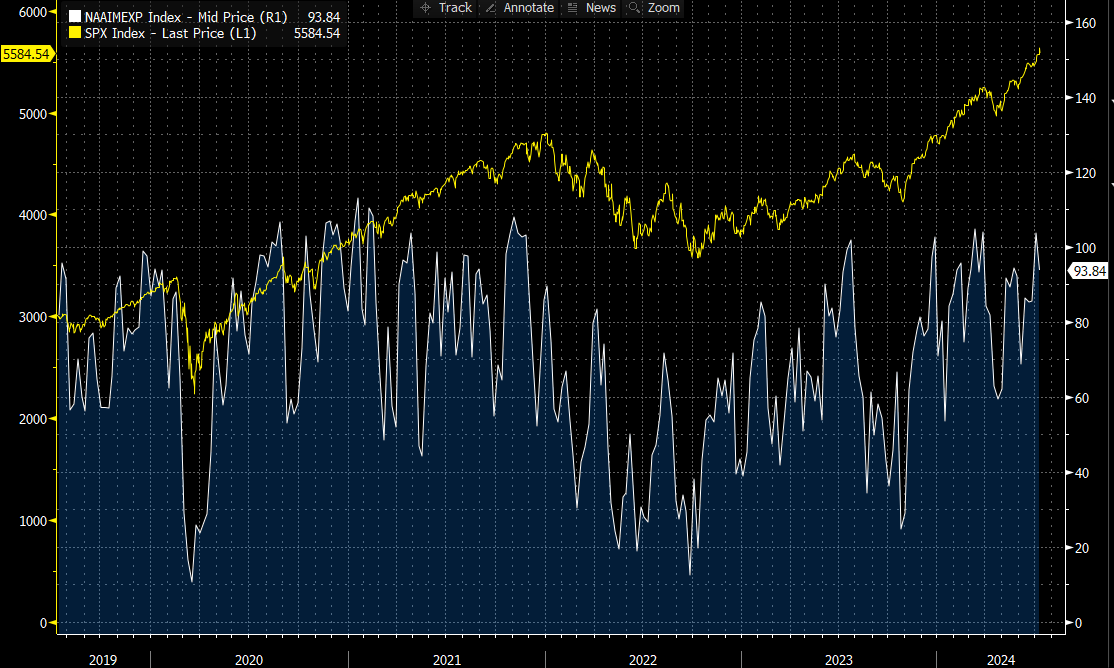

Despite these red flags, asset managers remain heavily long, with 90% exposure to the broader market. This overexposure could exacerbate declines as they adjust positions.

The Current Dilemma According to the SKEW Model:

Traders are currently unhedged, as indicated by the Skew Index and low put hedging activity. This lack of protective positioning heightens market vulnerability.

In conclusion, multiple indicators suggest heightened market risk. Our algorithm's short, unhedged trader positions, significant long exposure among asset managers, historically low stock concentration, and an expected rise in volatility all point to a potential SPX drawdown of at least 10%.

We advise caution and strategic risk management for these upcoming volatile times.

© Copyright. All rights reserved.

Wir benötigen Ihre Zustimmung zum Laden der Übersetzungen

Wir nutzen einen Drittanbieter-Service, um den Inhalt der Website zu übersetzen, der möglicherweise Daten über Ihre Aktivitäten sammelt. Bitte überprüfen Sie die Details in der Datenschutzerklärung und akzeptieren Sie den Dienst, um die Übersetzungen zu sehen.